tax avoidance vs tax evasion hmrc

The difference between tax avoidance and tax evasion essentially comes down to legality. Tax evasion means concealing income or information from the HMRC and its illegal.

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

The tax evasion vs tax avoidance debate is a long-standing one.

. It often involves contrived artificial transactions. For example getting taxable income as loans or other payments youre not expected to pay back. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

This is much easier to define as to have. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. HMRC define a tax avoidance.

In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two. Avoiding tax is legal but it is easy for the former to become the latter. HMRC does not approve any tax avoidance schemes.

Tax planning either reduces it or does not increase your tax. Tax avoidance has always created interesting news. Unsurprisingly this is an area where HMRC are making great strides with many new measures being introduced to help crackdown on tax evasion.

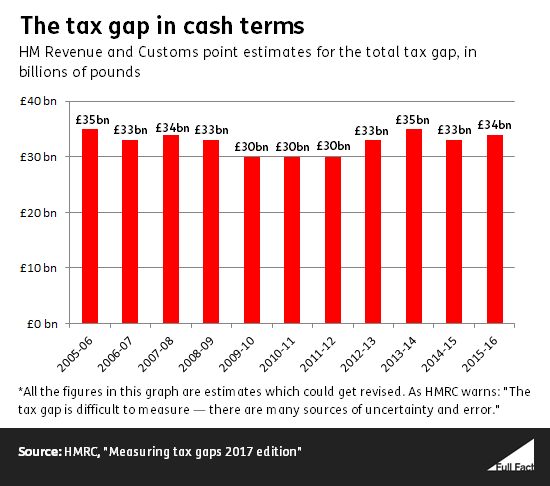

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. It always creates a lot of anger and questions about how to get away with. In fact it was announced in the Spring.

According to Hyde 2010 tax evasion cost the UK treasury over 15 billion annually. Yet the volume of income tax receipts collected by. A tax avoidance scheme is an artificial arrangement to avoid paying the tax.

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended.

Tax evasion is a felony. The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two. With recent gov.

Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the. It is estimated that in 201920. Schemes it is likely that HMRC will uncover companies whove claimed what they shouldnt.

Between the 202021 and 202122 financial years overall HMRC saw a 25 increase in total tax receipts received. Discover more about tax avoidance and evasion. It even makes big news for celebrities and large multinationals.

On 16 Feb 2022. This is approximately 3 of the total tax liabilities that individuals and. Schemes HMRC has concerns about You can find examples of tax avoidance schemes HMRC is looking at closely.

Budget 2015 George Osborne And Tax Avoidance

Follow The Money An Exercise In Tax Evasion And Avoidance

Hmrc Empowered To Name And Shame Tax Evasion Enablers Tax Avoidance The Guardian

Hmrc Reports Shift In Promoted Tax Avoidance Scheme Market Step

Hmrc Sets Sights On Offshore Accounts Blue And Green Tomorrow

Hmrc Receives 73 000 Tax Evasion Reports Ftadviser Com

U K Panel Questions Hmrc S Ability To Fight Tax Avoidance Insights Bloomberg Professional Services

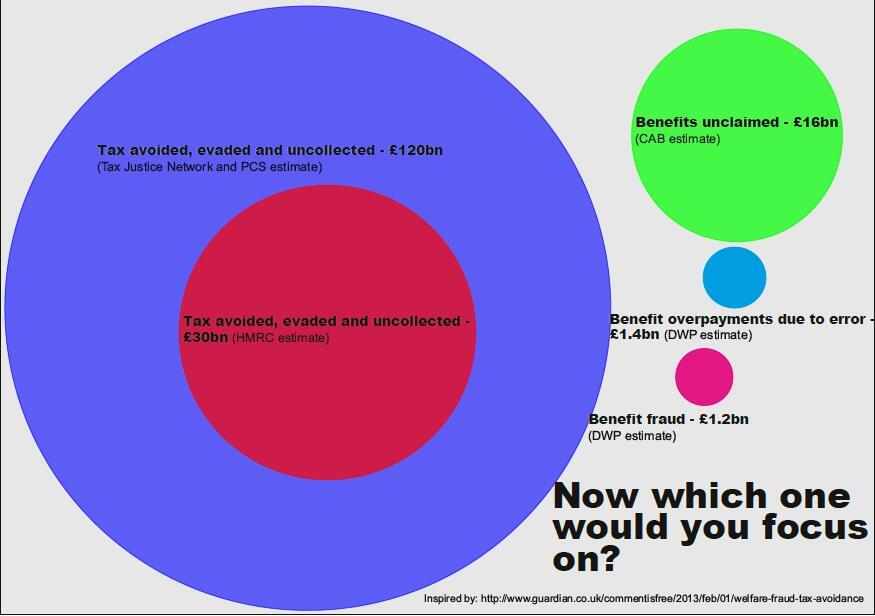

Tax Dodging How Big Is The Problem Full Fact

Simon Griffiths On Twitter Cost Of Tax Avoidance Evasion Vs Benefits Fraud Https T Co Mm8efwb3ot Via Newsframes Twitter

Uk Tax Evasion Crackdown Expected To Net 2 2bn Financial Times

Tax Evasion Questions Lecture 9 If You Need Quesions To Give You Focus Feel Free To Answer Studocu

Tax Dodging And Benefit Grabbing The Scale Of The Problems Full Fact

Tax Evasion Vs Tax Avoidance 4 Rules You Should Follow Youtube

Tax Evasion Vs Benefit Fraud R Ukpolitics

Hm Revenue And Customs Sign In Fill Out Sign Online Dochub

Hmrc Names And Shames Tax Avoidance Schemes Recruiter

Changing Tax Avoidance Attitudes Hmrc Research Tax Evasion

Grass Your Tax Dodging Spouse Or Boss To Hmrc And Get Up To 250k As A Thank You The Sun